Once my broke student days were further behind me I started looking into budgeting tips. I insisted (to myself, of course) that I would not change my spending habits just because my income has changed assuming that this mindset would put me on the path to savings glory.

First thing was first, a reality check. There is nothing glorious about saving, taxes were taking a significant portion of my salary and I needed to get my own credit card moving forward. The credit card connected to my parents bill was being cut… both literally and figuratively speaking.

Since then I have learned the importance of quickly getting back on track after modifying your budget, tracking your credit card statements and most importantly, the lesson of liquidity.

My biggest mistake so far came with poor timing, fortunately it had no financial consequences, it just caused me a lot of additional stress when it wasn’t necessary. I moved my savings from my spending account into my TFSA (tax free savings account) with a high risk savings portfolio and left my spending account somewhat sparse but with enough to last me for two months of spending. Unfortunately, this was a mistake. That month the hot water tank leaked and needed to be replaced, I ended up with a flat tire that required all four tires to be replaced and on top of that I booked a trip. This is where the liquidity lesson comes in. I think that I was just really excited to have been saving as much as I had and moved my savings to soon.

Fortunately, I had just enough to cover my expenses without dipping back into my TFSA but I cut it closer than I felt comfortable. I think that patience is a key part of financial growth and even though I could have done without the stress I am glad to have learned the lessons that I have with little penalty.

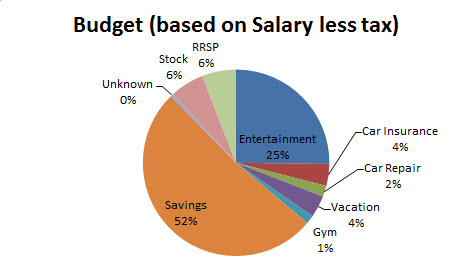

I have also learned that there isn’t a universal budget that will lead to success, everyone’s spending and savings habits are different. Everyone’s budgets need adjusting over time as well. Below is a pie chart of my budget… for the time being..

I think that I am like most people and want to increase the saving portion and lower the entertainment expenses. What can I say, I like to have fun. I think that a realistic goal is for the unknown expense and some entertainment expense to both go into savings just to increase it to the 55% mark. I hope that reading about my experience has either helped to inspire you to stay focused or feel less bad if you’ve gone off the path in the past. Just remember to get back on track as soon as possible!